Overview

AgriFrontier Platform Limited (Sierra Leone)

Our flagship platform operating as Senehun Agri Platform focused on food production, land stewardship, and community-based agribusiness development in Sierra Leone.

AST-AAR Capital Investment Limited UK acts as the strategic sponsor and de-risking HoldCo, providing governance, capital structuring, and international investor engagement. Our focus is on building resilient, well-governed platforms that support sustainable growth, operational excellence, and lasting economic value.

Future Platforms

We are selectively developing platforms across:

- Renewable energy & power

- Logistics & trade infrastructure

- Healthcare delivery

- Technology-enabled services

- Sustainable real assets

Areas of Focus

Our Model

Sponsorship Model

We act as permanent capital sponsors, integrating capital, governance, and operational expertise.

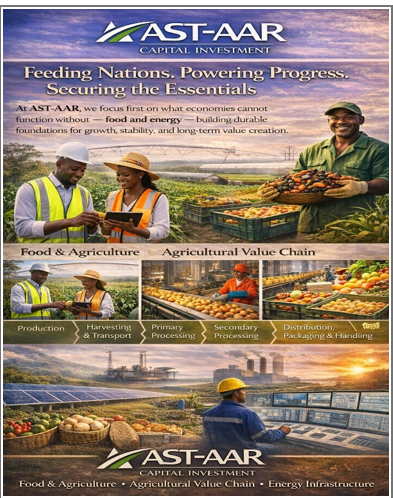

Feeding Nations. Powering Progress. Securing the Essentials

At AST-AAR, we focus first on what economies cannot function without — food and energy — building durable foundations for growth, stability, and long-term value creation.

Food & Agribusiness

We invest in scalable, community-anchored agricultural platforms that strengthen food security, regenerate land, and transform primary production into resilient, investment-grade assets.

Energy & Power Infrastructure

We support energy platforms that unlock productivity — enabling industry, logistics, healthcare, and households through reliable, decentralised, and future-ready power solutions.

Connecting Markets. Moving Goods. Building the Backbone

Growth does not happen in isolation. We build the physical systems that allow economies to move, trade, and scale — responsibly and efficiently.

Logistics

We invest in logistics and trade-enabling infrastructure that reduces friction, lowers costs, and connects producers to regional and global markets.

Real Asset & Property

We develop productive, income-generating real assets aligned with economic utility — housing, industrial, and mixed-use assets designed for longevity, affordability, and demand resilience.

Innovation with Purpose. Technology That Serves Real Economies.

Technology and healthcare are not standalone bets — they are force multipliers. We invest where innovation directly improves lives and economic outcomes.

Technology

We back technology-enabled platforms that improve efficiency, transparency, and access across essential sectors — amplifying impact rather than chasing abstraction.

Healthcare

We support scalable healthcare delivery platforms that expand access, improve quality, and strengthen system resilience across underserved regions.

Impact Is Not an Outcome. It Is the Design.

AST-AAR exists to steward capital with discipline and purpose — delivering resilient returns while shaping inclusive, long-term prosperity.

Impact-Driven Growth

Impact is embedded at inception — in how we select assets, structure capital, govern platforms, and measure success across generations.

Cross-Sector Stewardship

Across food, energy, infrastructure, logistics, healthcare, property, and technology, we align returns with responsibility.